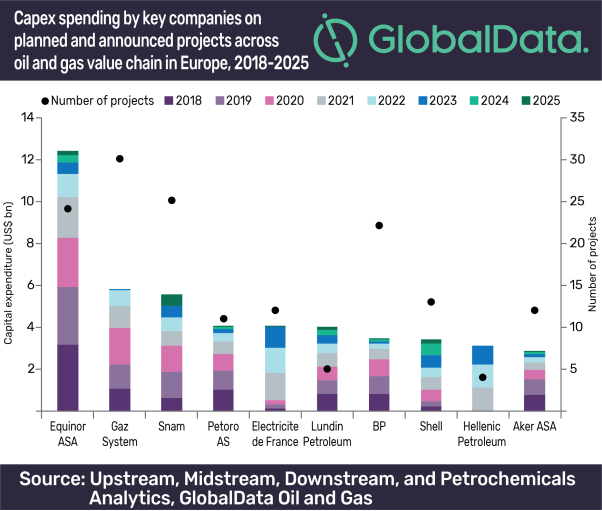

In Europe, Equinor ASA, Gaz-System SA, and Snam S.p.A. are the top three spenders among all oil and gas companies on new build capital expenditure (capex) for planned and announced projects across the oil and gas value chain by 2025, according to GlobalData, a leading data and analytics company

GlobalData’s latest report, ‘Top Oil and Gas Companies Planned Projects and Capital Expenditure Outlook in Europe – Equinor Leads Capital Spending Across Oil and Gas Value Chain’, reveals that Equinor ASA tops the companies European spend list with an estimated capex of US$12.4bn expected to be spent on 24 projects. Gaz-System SA and Snam S.p.A. are the second and third biggest investors with US$5.8bn (30 projects) and US$5.6bn (25 projects), respectively. With Petoro AS in fourth position with US$3.8bn (7 projects) and Lundin Petroleum in fifth with US$3.7bn (3 projects).

Soorya Tejomoortula, Oil & Gas Analyst at GlobalData, comments, “Whilst Equinor ASA leads in planned and announced projects, Falcione Energia S.R.L is the number one capex investor in European new build regasification, with an estimated US$0.7bn spend on the upcoming Eagle Floating regasification terminal in Albania.”

Upstream

In the upstream sector, Equinor ASA has the highest new build capex commitment of US$11.9bn (21 projects) between 2018 and 2025.

Midstream

Gaz-System SA will be the major spender in midstream sector, primarily focusing on oil and gas pipelines with a capex spend of US$5.1bn to bring 29 planned and announced projects online by 2025.

Underground Gas Storage

In the gas storage segment, Snam S.p.A. leads with estimated capex of US$2.5bn to be invested in 14 planned and announced gas storage terminals by 2025 and International BV will lead with capex of US$0.7bn expected to be spent on Maasvlakte, an upcoming liquids storage terminal in the Netherlands.

Petrochemicals

Grupa Azoty SA is expected to lead the petrochemicals sector to 2025 with a capex of US$748m during 2018–2025.

Gas Processing

Grupa Lotos SA is at the forefront of gas processing with US$1bn allocated to the Baltic gas processing plant in Poland.

Liquids Storage

In terms of liquid storage, H.E.S. International BV is in the forefront with capex of US$0.7bn expected to be spent on an upcoming liquids storage terminal, Maasvlakte, in the Netherlands.

About GlobalData

4,000 of the world’s largest companies, including over 70% of FTSE 100 and 60% of Fortune 100 companies, make more timely and better business decisions thanks to GlobalData’s unique data, expert analysis and innovative solutions, all in one platform. GlobalData’s mission is to help our clients decode the future to be more successful and innovative across a range of industries, including the healthcare, consumer, retail, financial, technology and professional services sectors.